It’s earnings season again!

In today’s issue, I recap Cloudflare’s latest fundamentals, cutting-edge AI opportunities, and strategic product positioning.

Join me on a journey of discovery as we take a closer look at the facts, scrutinize the numbers, and ultimately determine if Cloudflare is worth your investment dollar.

Revenue & Guidance

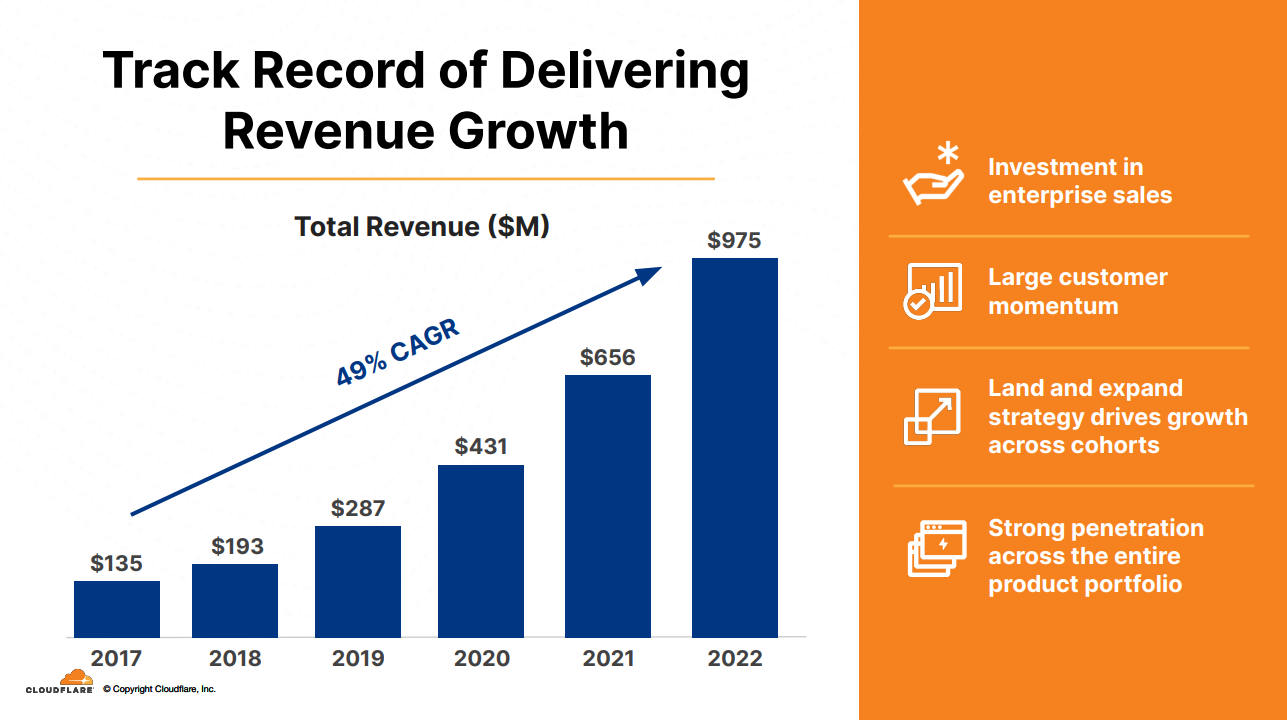

Well, I was hoping for more revenue growth and expected around $280M. We got Q4’22 revenue of $274.7M, or 42% YoY. While it's less than I expected, it is still solid for the current environment. 2022 fiscal year growth came in at 49% YoY, a total of $975.2M.

Regarding its guidance, NET claims to be very prudent and “not relying on any improvement in sales or marketing efficiency or any rebound in the economy as we look at the year ahead and formulate our guidance.” I am not sure if they really didn’t “bake” any positive trends into their forecast. Since their guidance seems somewhat optimistic.

Either way, I expect them to achieve what they guided for (and a bit more). I have a hard time believing that Prince would risk missing guidance for the first time in history for a “quick win”. Easy comps should also make things easier from mid ’23 on. This is what they guided for:

FY’23:

Expect network Capex to be 11% - 13% of revenue in 2023.

Expect revenue at $1.330B - $1.342B, or 37% YoY at the midpoint.

Expect operating income at $54M - $58M.

Q1’23:

Expect revenue of $290M - $291M, or 37% YoY.

Expect operating income of $11.5M - $12.5M.

Cashflow & Profitability

Unlike revenue, Cloudflare nailed profitability and promised to remain cashflow-positive. That is great news for many of us who were waiting for NET to finally become serious about profits.

While the pricing change and some smaller savings in Capex and Operation costs (as % of revenue) might have favored profits, it seems that it is mostly organic and not driven by trade-offs with important investments and growth. These are the numbers we got:

Non-GAAP gross profit of $212.5M, or 77.4% gross margin, compared to $153.3M, or 79.2%, in Q4’21.

Non-GAAP income from operations was $16.8M, 6.1% of total revenue, compared to $2.3M, or 1.2% of total revenue, in Q4’21.

Record Cashflow:

Cash Flow: Net cash flow from operating activities was $78.1M, compared to $40.6M in Q4’21.

Free cash flow was $33.7M, or 12% of total revenue, compared to $8.6M, or 4% of total revenue in Q4’2021.

$1.6 billion in cash, cash equivalents, and available-for-sale securities (remains unchanged).

Sales & Marketing

Prince identified room for improvement in their Sales motion, especially as “products become more complicated, and we are selling to larger and larger customers […]”. He even stated he felt some […] embarrassment, over some of the basic things we should have been doing better, but my second reaction was excitement as there are so many opportunities for us to improve.

Of course, it is not great for us investors to hear that their Sales & Marketing efforts are not going that well currently. However, they are addressing the issues they are seeing. And, despite the difficulties in Sales, they still show healthy customer activity. So I believe there is potential and expect their effort to materialize towards larger customers.

Finally, Cloudflare is seeing positive trends in its partner channel, with one interesting new addition: Palantir. This could be interesting regarding Palantir’s ties with the government.

Customer Activity

I already teased the Sales focus on large customers, so let’s look at customer activity. We saw strong customer activity trends in the >500k cohort. The other large customer cohorts (<100K, <1M) were a bit slowed down, but still solid. Next quarters I hope to see the increased GTM efforts on large accounts materialize further, and growth and DBNRR tick up again.

DBNRR is down to 122%, however, they are confident about long-term 130% after new products get traction and are not seeing elevated churn, but rather customers downgrading.

Customer activity:

Total customers:

Total paying customers came in at 162,086. representing a sequential slow-down from 24.3%, 19.8%, and 17.8% in the quarters before to 15.7%. As long as the large customer cohort keeps growing as % or revenue as well as overall, I am not overly worried about this trend.

<100K customers:

+134 large customers, totaling 2,042 large customers, incl. 33% of Fortune 500.

Revenue from large customers grew 56% year over year, contributing 63% of total revenue (up from 61% previous quarter). A nice trend showing their efforts in targeting larger customers seems to be moving in the right direction.

<500K customers:

Total of 222, up 83% YoY. Representing a very nice increase from 70% the year before.

<1M customers:

Total of 85, up 53% YoY, but down from 75% in the previous year.

Product Strategy, R&D & competitive positioning

Rapid development, a strong product suite, and a significant moat are probably Cloudflare’s biggest strengths. Let’s see what they’ve got this time.

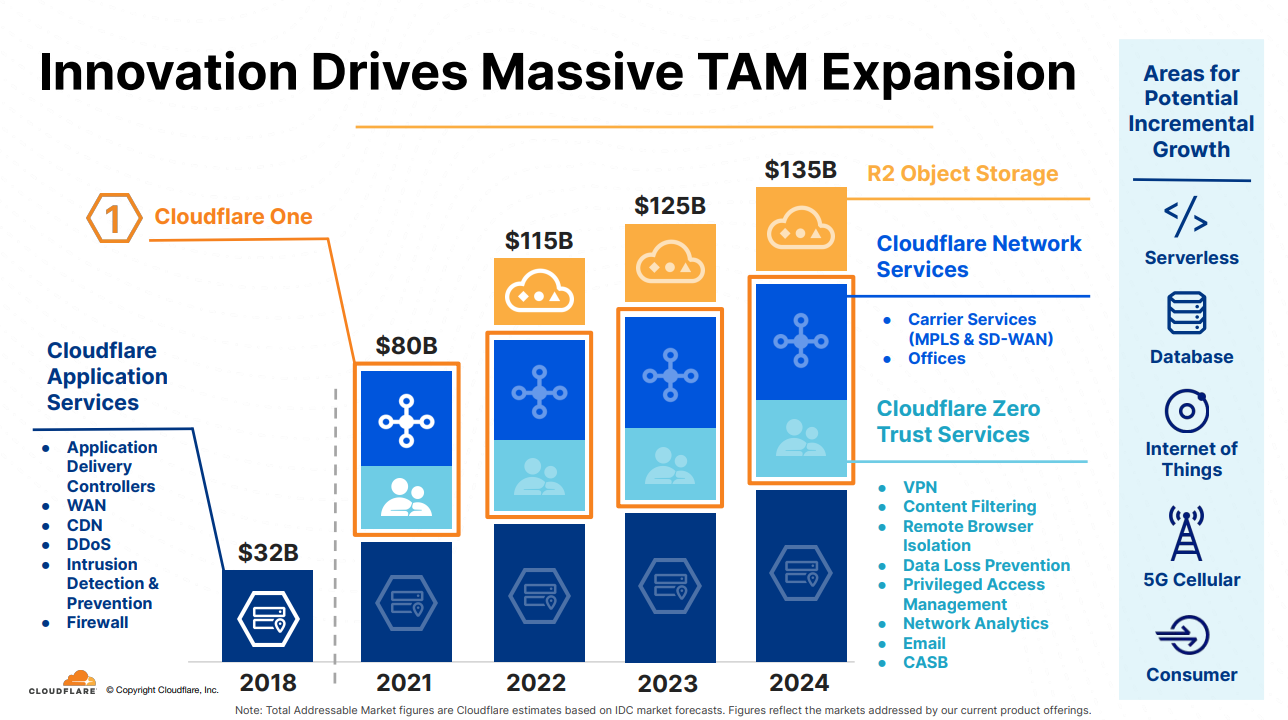

Cloudflare promised new feature enhancements, especially around their Zero Trust products for innovation week. In the Zero Trust space, they claim to be winning in deals a lot, mainly thanks to their unified network, reliability, and performance.

They also iterated on the fact that their “technology is built from the ground up on a single platform rather than a Frankenstein solution bolted together through M&A.”

Another trend, that is hard to ignore: Artificial intelligence.

As a strong product innovator, NET is also winning with several AI customers, most notably (and, supposedly) with OpenAI, the provider of ChatGPT. The company started many years ago as a free tier user ad now signed a 1M deal. Why?

Cloudflare’s multi-cloud capability. With R2, they allow companies to store their training data in a neutral place, where it can be accessed from basically “anywhere”, technically speaking. That makes R2 a perfect storage for AI training data.

NET’s built-in security.

Data localization. Especially in regulated markets like the EU, data localization is a huge advantage.

What else? They now officially received FedRAMP certification and won their first $7.2M 5-year deal to operate the .gov registry. Since the public sector only accounts for 3% of its revenue today, they believe in future potential.

There is one quote about the worldwide infrastructure that I would like to highlight since it explains the high Capex costs they spend building this strong moat: “And it [the network] is not something that you can just throw money at and buy your way into, it’s not something that even some of the large hyper-scale public cloud has. […] Any of those things actually help us lower our costs because it drives down the cost of delivering all of our services.”

Other insights

A few other insights from the Conference Call, that did not fit properly into the other categories:

Cloudflare’s pricing increase went smoothly, with no elevated churn. Most users are switching to annual billing, so the effect goes rather to the bottom line (profitability), than the topline (Revenue).

They commented on prudent hiring, no layoffs, and a very promising pipeline of talent to power their product development and Sales engine.

No more comments around currency headwinds internationally (as mentioned in previous quarterly results).

They are still seeing “businesses measuring twice before cutting”, but there was much less emphasis on elongated sales cycles than in the previous results.

My Takeaways & Investment Decision

While Cloudflare is “struggling” a bit on the S&M side and revenue came in less than I expected, it continues to be a world-class organization. Pumping out products and features like madmen.

They have a very strong product and a powerful moat with their hard-to-replicate, worldwide infrastructure, and core technologies that meet today’s demands for compliance (Bonjour, European market!), performance (every tech company worries about performance), and reliability.

They can do R&D well, so I don’t worry about that.

So, what I will be looking at going forward is:

Durable revenue growth.

Improved Sales motion, large customer wins, and increasing contribution of large customers to total revenue.

More government business.

Focus. NET is developing many great things, and often they are surprised at use cases that customers come up with. There is still much potential in selling existing solutions for new and old use cases, to new and old customers.

All in all, I feel comfortable with my current mid-teens allocation. I will wait for some more reports to get a better grasp on the current situation of our companies and potentially make any portfolio adjustments from there.

Thanks for reading, good luck to all of you out there & Happy Weekend!

Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. Please see our disclaimer for more details.

Please note: The text is based on the information available at the time. Investment decisions can change at any time based on new information.

Sources: All information and visuals are from Cloudflare’s Investor Relations website.