Confluent (CFLT) Q1 '24 Earnings Recap

58% YTD: Simplifying mission-critical real-time data management

Confluent (CFLT 0.00%↑) is a new, small trial position.

Why: A potential candidate for durable, long-term growth due to its mission-critical aspect, which allows it to integrate itself into the core of a business.

What: Confluent simplifies real-time data management, enabling you to build modern applications and gain insights without worrying about the technical details.

How: For example, a retail company can use it to seamlessly integrate data from physical stores and online platforms, improving inventory management, sales forecasting, and customer experience.

Confluent's cloud offering has a Total Cost of Ownership (TCO) advantage over self-managed data systems (open source) due to lower infrastructure costs and reduced need for software engineers and operations staff. This advantage allows customers to reallocate engineering time to innovation and reduce deployment times while still benefiting from comprehensive features and functionality.

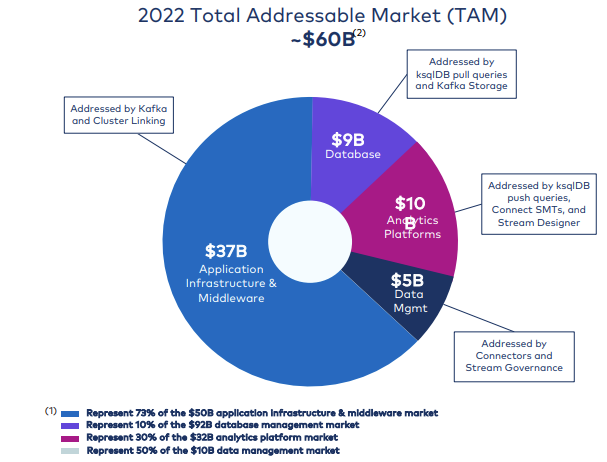

As a result, Confluent is positioned as the leader in a $60 billion market opportunity in 2022 and $100 billion by 2025. This indicates a large and growing market.

If you want to dive deeper, I suggest reading Peter Offringa's excellent write-up on Confluent.

Let’s dig into the numbers:

Revenue & Guidance

Revenue in Q1 was $174M, representing a YoY increase of 37.9% and a QoQ increase of 3%. Overall, I am satisfied with the revenue figures, especially considering that Q1 is usually a slower quarter. Furthermore, the provided guidance further below looks promising.

Bolding is mine:

From a consumption basis, we did see a little bit of an impact relative to some of the consumption trends in our cloud business in the second half of March and we saw that manifest itself in the financial vertical. What we did see though in April is a nice bounce back and so we saw return to normal patterns for the consumption business and the financial vertical. […] I think in some customers, both in tech and in financial services, there was a fair amount going on in the organizations.

Like other businesses that are more exposed to the tech and financial industries, this business felt a negative impact due to macroeconomic effects and the SVB incident. It is encouraging to see a return to normal patterns.

Confluent's revenue is divided into three main categories:

Service Revenue: Accounts for 8% of total revenue and is declining. Good.

Cloud Revenue accounts for 42% of total revenue and is increasing. Last quarter, it was $74M, up 89.7% YoY and 8.8% QoQ. This part of the revenue is consumption-based, which can result in a sharper slowdown in adverse environments, but with greater potential for upside later on. Management explained that the modest increase in cloud revenue mix (41% the prior quarter, 42% this quarter) was due to the outperformance of Confluent Platform in the quarter:

Platform Revenue: This is 50% of total revenue and declined to $86.9M, down 16% YoY. Confluent Platform performed well in the public sector vertical, exceeding expectations.

Subscription-based revenue, which includes Cloud and Platform, accounts for 92.3% of Clonfluent's total revenue and is steadily increasing. This portion amounted to $160.57M, representing a YoY growth of 40.9% and a QoQ growth of 3.4%.

In my opinion, Confluent's main investment thesis is based on cloud revenue. Ideally, the majority of the company's revenue would come from this category. As shown in the graphic above, Confluent is on track to achieve this goal and management has also noted an increase in sequential revenue every quarter for the remainder of the year.

Remaining Performance Obligations (RPO) amounted to $743M, which is only a 0.3% sequential increase. Although RPO growth is "healthy" it was impacted by a decline in average contract duration and additional budget scrutiny, which elongated the deal cycle in comparison to the eight-figure TCV deal closed a year ago. RPO will be a key metric to watch.

However, the growth in Current RPO accelerated this quarter, which management explained was due to the great work of the sales and go-to-market organizations.

Looking at the geography of revenue, the U.S. accounts for 60% of the total revenue (32% YoY growth), while the remaining 40% comes from international sources (49% YoY growth) and is steadily increasing:

Cashflow & Profitability

Gross margin was 72.3%, up from 69.7% in the same quarter a year ago. The gross margin is going to improve over time due to the shift to more cloud-based revenue.

Operating income improved to -$40.3M (-23.2% of revenues) from -$51.67M last year. Net income also improved to -$25.49M (-14.6% of revenues) from -$52.49M last year. Both Operating and Net Income as a percentage of revenues are improving rapidly.

Management was pleased during the earnings call that Confluent is able to deliver high top-line revenue growth and improve operating margins, with the goal of reaching breakeven in Q4 this year. Earnings per share increased to -$0.09, up from -$0.19 a year ago.

Operating cash flow for this period was -$77.77M (-44.7% of revenues), down from -$55.03M last year. Free cash flow was -$82.9M (47.6% of revenues), down from -$58.43M a year ago.

Although these numbers may seem alarming, they were impacted by charges related to restructuring, the Immerok acquisition, ESPP, and a corporate bonus payout, all of which were discussed on the last earnings call.

Therefore, we can view these charges as a one-time impact, and expect significant improvement in cash flow going forward. This is a key metric to keep an eye on.

Lastly, they have $1.85B in cash, providing ample runway, so there are no concerns in this regard.

Guidance

Management expects Q2 revenue to reach $183M. Achieving a typical beat would result in a 9.1% QoQ increase and indicate stabilization or slight improvement compared to the previous three quarters.

The full-year 2023 revenue guide remains the same as last quarter at $765M. Assuming a typical beat, revenue growth will end up at $788M or 34.4% YoY. Management assumes additional budget scrutiny and no improvement in the business environment for the remainder of this year.

To keep me interested, I would like to see a raise going forward. Key metric to watch.

In Q2, cloud revenue is expected to bring in $83.2M, a 77% YoY increase and a 13% QoQ increase.

For the full year, management has mentioned that sequential cloud revenue will be $8 million. They also expect cloud sequential revenue to increase every quarter for the rest of 2023, with an exit target of 50% cloud revenue share, up from 40% now. A favorable development.

Customers

Confluent added 160 total customers in the quarter, bringing the total to 4,690.

The number of customers spending $100k or more increased by 60 to 1,075, up 33.9% YoY and 5.9% sequentially. This cohort contributed over 85% of total revenue, making it a key metric to watch.

In addition, Confluent added 8 customers spending $1M or more, bringing the cohort to 135 customers. This is up 53.4% YoY and 6.3% sequentially.

All customer cohorts are experiencing a sequential slowdown. Although this trend is common among software companies, I find customer growth to be the least exciting aspect of Confluent's puzzle. To maintain my interest, I would like to see this trend change in the future.

Customer Happiness Metrics

Gross retention rate has exceeded 90% and the dollar-based net retention rate (DBNRR) was over 130%. However, in Q2, the DBNRR is expected to be less than 130% due to customers being more budget-conscious. The old methodology resulted in a DBNRR of 125%, but the company switched to a consumption-based net revenue retention for Confluent Cloud, which raised the NRR to above 130%.

Management believes that this is a better reflection of the actual underlying growth drivers and is consistent with our peer group companies that have a consumption-based model. Consumption-based DBNRRs are naturally higher, and this should increase significantly once customers consume more after the macro fades. This is another key metric to keep track of.

Since everyone is talking about AI nowadays, I liked their reply to an analyst’s question, if AI is a headwind or accelerator for them. Jay Kreps, Confluent’s CEO, replied “Absolutely an accelerator”.

Valuation and Market Cap

When I initiated my tiny position for around $20 on May 3rd, the stock price surged by 40% to $28, increasing the market cap to $8.6B from $5.9B in less than a month.

The forward EV/S ratio of 10 looks reasonable compared to similar companies in the software space.

Now, you might ask, "Is that cheap?"

Although I consider valuation to be the least important criterion for my own investment decisions, it is still a puzzle piece that should be considered. As usual, its significance depends on the circumstances:

If Confluent proves to be a mission-critical software provider that integrates deeply into a business's stack and demonstrates accelerating growth in revenue, customers, and usage, then I would consider the valuation cheap and the market cap very low.

Investors usually look at valuation as a "magic formula," but it isn't that simple. I've thought about this topic many times over the past years and may write about it if there is enough interest. Let me know on Twitter!

I would like to end this write-up with a quote from the last earnings call, emphasizing the mission-critical aspect of Confluent:

Question: "[…] can you give some more specific examples from a vertical-specific use case about expansion -- both expansion and new use cases that give you confidence in achieving your targets this year?":

Yes, absolutely. I mean you would see this across virtually every industry. The one that we called out in the earnings was this large expansion in financial services. Yes, that's an industry that obviously, a lot is happening in. And so the willingness to make big bets on this in the cloud, right? These are organizations that are very sensitive about security, about compliance, et cetera, really do a thorough job of betting. The willingness to make a big bet in this area is really one of a small number of third-party cloud infrastructure of vendors. I think that speaks to how critical this area is. And you could probably come up with a similar example in any other industry of interest, whether that's retail, insurance, automotive, public sector, really exciting things happening in each of those.

My Investment Decision

I started my position at CFLT on May 3rd, and it has increased by 60% since then. However, the increase hasn't significantly impacted my portfolio due to its small size. That's okay, as I plan to keep it on my radar for now and increase it opportunistically.

I am intrigued by Confluent's "picks and shovels" business model and mission criticality, similar to companies such as MongoDB (MDB), Snowflake (SNOW), and Cloudflare (NET). These companies integrate themselves deeply into a business's software infrastructure, which should lead to durable growth for years to come.

While the current macro environment has muted the development of metrics like revenue and customer growth, I can imagine Confluent's growth picking up again once it fades.

To increase my conviction in Confluent, I need to see an acceleration in revenue growth and RPO, a continuation of strong customer additions, and a healthy DBNRR.

Additionally, margins should continue to improve, driven by the increase in cloud revenue share of total revenue. The goal is to break even by the end of this year.

I’m happy with my trial position and, as usual, will follow the numbers (+ narrative).