It’s been a busy earnings season. Today, I'm sharing my observations and thoughts on the earnings reports of Datadog and monday.com.

About half of the companies in my portfolio have reported earnings so far: NET 0.00%↑, BILL 0.00%↑, TTD 0.00%↑, DDOG 0.00%↑, and MNDY 0.00%↑ .

Portfolio update: As of today, my portfolio is up 23% YTD.

While macro conditions still impact revenue growth and net retention rates, particularly on the expansion side, I have observed encouraging data points in the reports.

Key Highlights:

Stabilizing Macroeconomy: Companies like bill, Datadog, and monday.com noted that the macro environment is stabilizing (“not getting worse”)

Revenue Performance: Quite some beats and raises, even if coming off conservative guidance. E.g. from Datadog, monday, and The Tradedesk

Strong Product Adoption: For instance, product module expansion (DDOG), consistent transaction volume (BILL), strong new product traction (MNDY)

Stabilizing Costs for Paid Marketing: monday noted stabilizing costs per ad, meaning that competition starts spending $ on Marketing again

Retention Rates: Net retention declined or is expected to decline for most, but gross retention remains high, indicating low churn

Customer Growth: Customer growth is also pressured, but many companies report record new logo or enterprise customer growth

And with that, let’s dive into the recap of two of my companies’ reports.

Datadog - DDOG 0.00%↑

Datadog delivered a solid quarter. Revenue was $481M, up 33% YoY and 2.6% QoQ, beating its conservative guidance by 2.5% and raising full-year outlook by 0.5%. It’s a small raise, but it is one. This excludes the $5M in revenue that Datadog lost due to an outage.

Looking at customers, I expected Datadog to add 180 large (> $100k) and 1,000 regular customers. We got 130 large, and 900 total customers, to which we can add 1,400 from an acquisition. While it’s hard to win customers in this environment, I am a bit disappointed. Net retention rate remained at 130+ % but is expected to drop. This is a trailing 12 months metric, so effects can be laggy.

Profitability looks great with a FCF margin of 24% and a stable gross margin of 80%. No cash issues here.

Datadog commented that they don’t see macro getting worse, but also not better any time soon. Cost optimization is most pronounced for larger customers who are further along in their cloud journey.

My highlight was DataDog's product adoption, which shows that companies are seeing value in its product and expand into new modules. Even in the current environment. I also like that DataDog is strengthening its relationship with Google GCP and Azure in terms of sales and product offerings.

My Investing Decision

⟶ I had an outsized 18% position that I will trim to 13 %. Datadog’s quarter was solid, but not strong enough to maintain such an outsized allocation.

monday.com - MNDY 0.00%↑

This relatively small company with a $7B market cap managed to accomplish big time. It offers a real open platform, and a strong partner ecosystem, develops leading products, expands its enterprise customer base, and outperforms on both top and bottom lines. Additionally, it gives back to the community through countless ESG projects. Let’s start with its top line:

monday's revenue was $262.3M, 50% YoY, slightly below my expectations of $363M+, but beating Q1 guidance by 4%. Sequentially, Monday grew 8.3%, decelerating from previous levels, yet still outpacing most other companies in this quarter. monday's full-year outlook was raised by 2% to $706M, reflecting strong performance in the current environment.

More outperformance in the bottom line: monday achieved break-even for the first time with an operating margin of (0%), driven by better-than-expected revenue, internal cost optimizations, and slightly below-plan headcount. monday expects its operating margin to improve further to 1 - 2% throughout this year.

Further, it pushed out another quarter of an incredible 90% (!!!) gross margins and added a record cash flow of $38.7M, with an FCF margin of 24%.

Turning to customer activity: monday’s net retention is pressured by macro — especially larger customers hesitating to expand seats (seems to be a pattern for growth companies lately). It might drop a little further to 115% for all customer cohorts, but this drop is expected to be offset by strong top-of-funnel traction. Positive: Gross retention remains stable, so no elevated churn.

My highlight of this report was the record enterprise customer growth: monday added 209 net new large customers with >50k ARR, representing 75% YoY and 14.2% sequential growth, up from 11.4% last Q.

Large customers sequentially outgrowing revenue shows me there is significant future growth embedded.

Why monday.com Is Not Just Another Task Management Tool

I feel like monday is often put into one bucket with Asana and Co.

I strongly disagree.

Here’s why:

monday is not simply a task tool, but a flexible, open platform that can be used for a variety of purposes

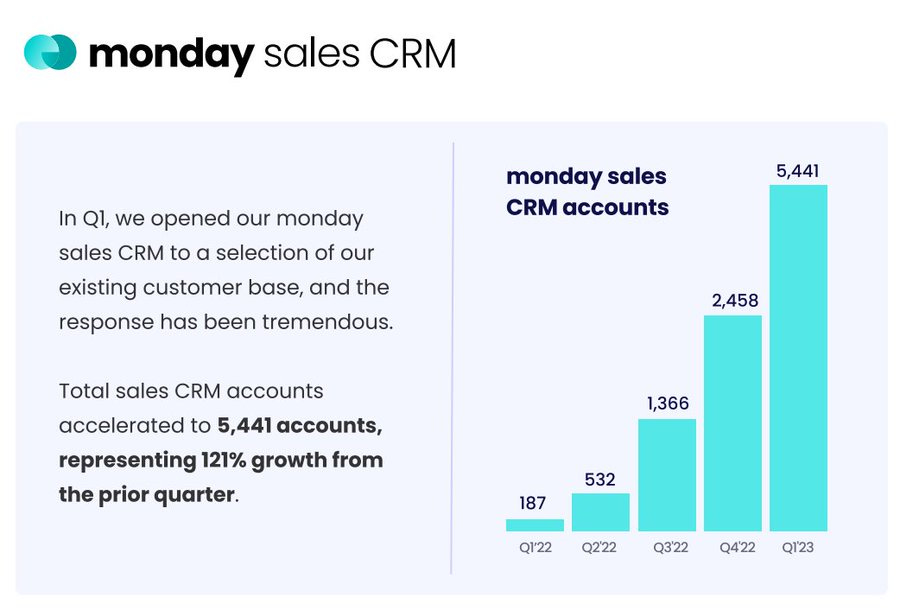

It offers specific solutions to specific use cases with incredible traction, like developer and marketing tools, and CRM, growing 121% (!!!) sequentially

monday follows a “land & expand” model. It can land new customers, e.g. with its CRM, and then expand these customers into additional use cases powered by its scalable platform

A powerful partner ecosystem and app marketplace provides network effects that help Monday resell customer-/partner-developed solutions for countless use cases

The company is highly data-driven, with an intelligent marketing strategy and a constant feedback loop from customers using the platform.

monday seems to always stay ahead of the curve - e.g. with its latest AI innovation.

My Investing Decision

⟶ I bought more monday.com in April and got into earnings with a 7% position. After this great report, I want more and will increase my position to 13% - 15%.

Closing Thoughts

So far, the theme of this earnings season seems to be “not getting worse” and “better than expected”. While this doesn’t sound that exciting, it is: Wall Street typically only looks 6-9 months ahead and priced our growth stocks for the worst-case scenario, which did not materialize. The latest market run shows glimpses of optimism and a more risk-on sentiment coming through.

Will it last in the short term? I don’t know.

But mid- to long-term I feel good about my companies and continue to hold them according to my conviction level.

Snowflake SNOW 0.00%↑ is set to report earnings next week on 5/24. I plan to share my thoughts on Twitter. Stay tuned!

Thanks for reading & following us on this exciting journey.🛣️

Happy Investing!

Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. So please always do your own due diligence and make your own decisions. See our disclaimer for more details.