Hey 👋!

The goal of my portfolio review is to help you understand how I think about investing, see what I'm doing, and help me learn, as well.

This review has 4 parts:

How my investments did, compared to the overall market

How my money is invested and how strongly I believe in each investment

The changes I made last month to invest in new opportunities or reduce risk

Updates on some companies I invested in

Disclaimer: This portfolio summary is for informational purposes only and does not constitute investment advice. I am not a professional, please don't follow me blindly and my perspectives could provide wrong conclusions.

1. How my investments did, compared to the overall market

Timestamp: 2/28/2023

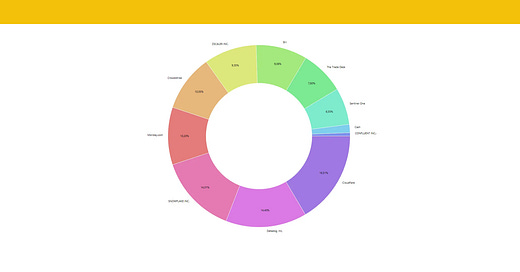

2. My Portfolio

Tier 1: Champions receive my highest conviction due to excellent company performance and execution. They typically have a 15+% allocation.

Tier 2: Contenders are either rising stars with good performance but lack full confidence or past champions with declining performance. They range from 5 % to 15 %.

Tier 3: Bench—These positions are either new ones I want to monitor/become familiar with or fallen angels I retain for some reason.

3. The changes I made last month

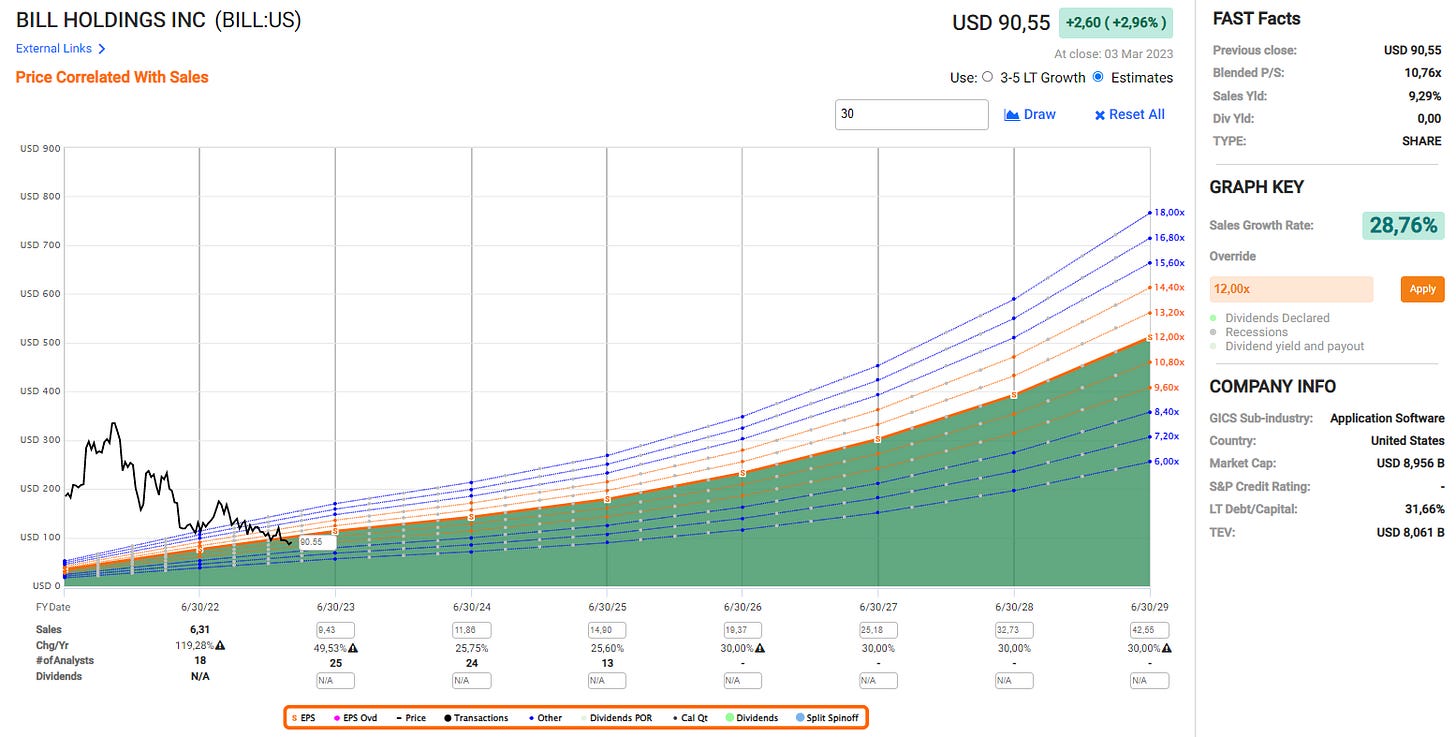

Trimmed: BILL

I lost some confidence since my last update. To recap, revenue fell from 94% year over year (YoY) in Q1 to 66% in Q2—a sharp slowdown. Further investigation revealed Bill seems to be a merger and acquisition (M&A)-Divvy story that is becoming too complicated for me.

Still, the >50% full-year (FY) guide gives me confidence. I might add back if the stock price keeps declining. I believe Bill is now at the lower end of valuation with a forward price-to-sales (P/S) ratio of 10.

Added: The Trade Desk

Although revenue growth is below 30%, The Trade Desk keeps gaining market share and is performing much stronger than its peers. They increased their platform growth in 2022 by 32% versus 8% for the total sector. Their ability to deliver high margins (50% adjusted earnings before interest, taxes, depreciation, and amortization [EBITDA] margin and 25% free cash flow!) gives me confidence.

The large total addressable market (TAM) of almost $1 trillion versus $175 billion for traditional linear TV, connected TV tailwinds, the opening of Netflix, and the shopper market should support revenue re-acceleration.

I added about 1% and plan to increase my position opportunistically over time to ~7%.

Added: Monday

Monday was one of the few reporting companies that surprised me positively. Many analysts congratulated them on the quarter. Sequential revenue growth stabilizes and the full-year guide looks decent considering adverse macro effects.

I'm closely watching customer growth, especially the $50,000+ cohort and the dollar-based net retention rate for the 10+ customers cohort. For both, I'd like to see a stabilizing or accelerating trend. Though, they expect a further decline in dollar-based net retention rate by end-2023 due to macro headwinds.

I added a bit after earnings and may continue opportunistically.

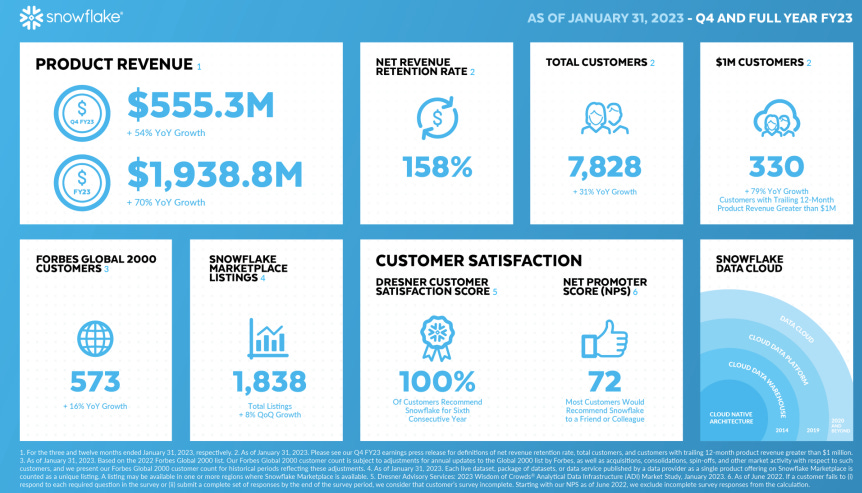

Added: Snowflake

I allocated part of Bill proceeds to Snowflake before earnings to increase the position to ~20%.

Added: CrowdStrike

The remaining Bill proceeds went to CrowdStrike before earnings to increase the very small position. I believe fundamentals remain solid.

4. Company Reviews

The purpose of my portfolio review is to provide an update on my portfolio and my decisions. I am not including deep dives on all the companies I am invested in, since that would be out of scope for this format. Still, I believe it provides value if I include a more granular update for my largest position. This time: Snowflake!

Please note: The numbers below relate to the latest quarter's earnings release. Metrics are adjusted values (Non-GAAP).

Snowflake

What they do: Provides data storage, management, and sharing for the cloud

Confidence tier: Champion

Type of revenue: Consumption-based

Trend to profitability: Yes

Cash: $5.1B

Revenue & Guidance

Product revenue was $555.3M, up 54.4% year over year and 6.2% quarter over quarter. I had hoped for at least 7.4% sequential growth. → Like other businesses, especially consumption-based ones like DataDog, Snowflake is struggling in this cloudy environment. No light on the horizon yet.

They guided to $573M for next quarter, suggesting 6.3% quarter-over-quarter and 49.6% year-over-year growth if they typically meet or beat guidance like in the past. → I assume slight acceleration since I expect next quarter to show slight growth due to the macro environment starting to improve.

Full-year 2024 product revenue guide is $2,705M, up 40% year over year. As initial FY guidance is always the most conservative one, especially for consumption-based businesses these days, I don’t focus on this number. My concern is the CFO’s preliminary FY24 guide of 47% (~$2,815M) in the Q3 earnings call. No need to guide the following year now, but for some reason, they did. Now, it’s backfiring. Analysts ignored this in the Q4 call, still confused why.

Full-year 2024 operating income margin guide is 6%, representing $173M, up from $95.28M in 2023.

Full-year 2024 free cash flow margin guide is 25%, representing $722M, up from $510.31M in 2023.

Remaining performance obligations were $3,661M, up 21.9% sequentially. RPO still grows faster than revenue sequentially, showing customers commit more and value what they get. However, RPO growth slowed (>40% sequential growth norm for Q4) since customers now commit to future spending only for coming quarters, not for years, like before. I expect RPO acceleration once businesses have more visibility from improving macro environment.

Cashflow & Profitability

Product gross margin was stable at 75%, in line with the previous quarters.

Operating income was $32.78 million, 5.6% of revenue, up from $18.06 million a year ago.

Net income was $48.41 million, 23.6% of revenue, up from $36.04 million.

Earnings per share were $0.14, up from $0.10.

Operating cash flow was $217.32 million, 36.9% of revenue (!!), up from $78.9 million.

Free cash flow was $205.26 million, 34.8% of revenue (!!), up from $102.1 million.

R&D expenses increased to $112.29M, 19.1% of revenue. → They continue to invest heavily in R&D, no slowdown here.

S&M expenses increased to $225.08M, 38.2% of revenue → No slowdown here, they continue to invest in capturing the market.

G&A expenses decreased to $1.04M, a reduction of about $3.5M compared to the Q4s of the last 2 years → For whatever reason they saved this tiny amount, it’s meaningless when looking at the big picture.

Customers

Added 520 total customers, reaching 7,828, up 31% YoY and 7.0% sequentially. → Customer growth continues to slow down, though sequential growth seems stable for 4 quarters now. Snowflake said larger customer cohorts matter more.

Added 19 Forbes 2000 customers, reaching 573, up 17% YoY and 3.4% sequentially. → Their historical numbers change each quarter: puzzling me. Without the change, they added 30 net new customers; with it, only 19. Slowing growth worries me.

Added 43 $1M+ customers, reaching 330, up 79.3% YoY and 15% sequentially. → Luckily, the key large customer cohort keeps growing steadily (and reached a record high in net new adds).

Customers using Stable Edge (data sharing) rose to 1,800, up 68.3% YoY and 23.2% sequentially. → More Stable Edge customers boost Snowflake’s network effect and moat.

Dollar-based Net Retention Rate declined to 158%. → While still excellent, optimizations from customers are emerging and likely to further reduce this metric in coming quarters (as it reflects the last 24 months). Still, management expects it to stay well above 130% long-term.

Additional Insights

Usage:

Newer customers are adopting Snowflake more slowly. Growth is slowing as the customer base expands. Customers still use Snowflake but spending increases at a lower rate.

Q4 bookings 90% of weighted pipeline vs typical 140% due to some big customers only buying enough capacity for a quarter or two instead of multiyear deals. But two big customers will run out of capacity in 6 months.

Snowpark's (one of their newer releases) usage will likely increase significantly in the second half of the year. The guidance doesn't include a significant impact, but the long-term impact will be more significant.

Snowflake might benefit from analyzing unstructured data like chat logs and social media.

International markets are growing more slowly than the US. Customers there increase spending more gradually. Some US customers used their initial allocation and increased usage.

Hardware and software improvements were a 5% growth factor. Most graviton upgrades were done in January. International underperformance was driven by more cautious, consumption-based buying in Japan and other Asian markets, which Snowflake doesn't target.

Industry verticals and market:

Telecom companies are Snowflake's largest customers and most significant data users.

The financial sector and media/tech/entertainment verticals are the largest. Newer tech sectors and VC-backed companies are slowing.

New markets: FedRAMP high and public sector coming soon, China strategy for global multinationals, investing more in Japan.

Telecom Data Cloud provides one platform to access and share data, enabling data-driven decisions and new services

Telecom companies like AT&T and M1 use Snowflake to transform digitally, improve customer experience, maximize efficiency, and monetize data

Snowflake partners offer industry solutions to reduce time-to-value and leverage data

Telecom Data Cloud helps integrate data, optimize operations, and generate new revenue streams

Partnerships:

The top 15 system integrators generated $1.6B in bookings last year. The relationship between their spending and Snowflake's revenue won't be disclosed.

Negotiations with Azure are ongoing. GCP usage is on track. Relationships with AWS and Azure will be strengthened, not just pricing.

Developing industry-specific solutions

Increase Sales & Marketing collaboration

Deepen product integrations

TL;DR: The goal is to provide customers with the best experience and accelerate innovation. By partnering, Snowflake and AWS can reach more customers, especially large enterprises.

Strategy and outlook:

Snowflake added 1,900 people in FY22, and will add 1,000+ in FY23 while improving margins and cash flow. Margins may increase if hiring slows.

Have $5.1B in cash, enough to fund growth and M&A.

Focus on high-quality customers over total customer numbers. Revenue per customer growing, 1M+ at 3.7K, G2K at 1.4K.

Revenue per customer will likely increase.

Authorized a $2.0 billion stock repurchase program → I like this move to fight dilution due to stock-based compensation. Looks like they are drowning in cash and they put it to use: $5.1B cash in the bank. At the same time, they are also investing in strategic acquisitions, which make sense to them, and investing in further headcount growth. Sounds like a healthy balance.

The relationship between operating margin and free cash flow will expand faster. The 6% free cash flow guidance will be updated.

Revenue guidance includes total customer adds and the ramp of large, well-funded companies, including pre-IPO unicorns. Exposure to VC-backed companies and their ramp rates are considered. Deal sizes haven't changed. Revenue retention guidance isn't provided.

My Take

I didn't like the CFO’s preliminary FY24 guide of 47% (~$2,815M) in their Q3 earnings call which they now had to revise to 40%. It still puzzles me. Besides that, here is my perspective on the business.

In my last portfolio update, I mentioned:

Due to the nature of the consumption model, quarter-over-quarter additions are not meaningful, since consumption is tied to what customers are doing at specific times in their business → Q4 has a seasonally higher number of holidays → People are off → 70% of revenue is tied to human interaction, 30% driven by scheduled jobs → to be aware of in their next earnings.

Now couple this with the optimization effects of customers getting their spending under control due to the ongoing macro environment. It’s not all as bad as it might seem!

Takeaway: Customers of consumption-based businesses can easily reduce spend, but this can snap back fast into the other direction as well. I believe, it will.

I still have a hard time seeing issues with Snowflake itself. Looking at it from a relative perspective (considering all other companies and the environment), I don't see why the thesis on growth durability for FY2024 and beyond should be broken.

Despite reiterating to remain on track to achieve their fiscal 2029, $10 billion product revenue target, consider this:

A business at this scale, generating half a billion in quarterly product revenue, producing over $205M in free cash flow, and still growing almost 50% next quarter (with a realistic beat), while having cloudy days above (macro) and beyond (digital transformation tailwinds), I believe this question is justified: When was there ever a time like that?

Long Story Short

On February 25, my portfolio's year-to-date return reached 25%, then fell 11% by month's end, ending at 14% year-to-date. So far, so good!

Bill, DataDog and Snowflake remain puzzling. I feel okay with my positions and may buy more Bill due to decent guidance. For now, I'll hold my large position and await more clues in upcoming quarters.

I expected a bad quarter since macro hurts all companies. From my last summary:

I expect 7.5 (0.5 for Snowflake) more disappointing earnings reports due to the macro environment. Unless isolated issues, we should be fine. This will end eventually. Time is on our side.

This happened (though, Snowflake also disappointed contrary to my belief), so it's important to remember why fundamentals are weak now.

One observation: Seat-based businesses stabilized last quarter, then consumption-based weakened this quarter. Does it mean layoffs and hiring freezes have stabilized? Will companies open up other budgets soon?

Makes sense: First freeze everything and control headcount, then ramp up slowly again.

Companies remain cautious with budgets and spending but may revise that in 2023's second half. I lack a crystal ball but expect another weak quarter (Q2 for most), then improvement in Q3 and beyond.

The next quarter should bring more clarity than the last few.

If so, the worst may soon be behind us!

Appendix

Earnings Calendar

My Watchlist

MongoDB - reporting on 3/8/2023

Okta - reported on 3/1/2023

Happy Investing, everyone!

If you liked this post, please give it a thumbs up. It helps to understand if it was helpful to you. Also, feel free to leave a comment if you have any questions or ideas for improvement. Thank you!

Disclaimer: This text is for informational purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. Please see the disclaimer for more details.