Greetings fellow life forms 🖖,

The purpose of this portfolio review is to give you insights into my thought process. Take it as learnings for your own investing journey.

The review is structured into 4 parts:

The performance of my portfolio versus benchmarks

The allocations of my portfolio and my conviction in each position

The actions I did last month to align my portfolio with my conviction

My thoughts

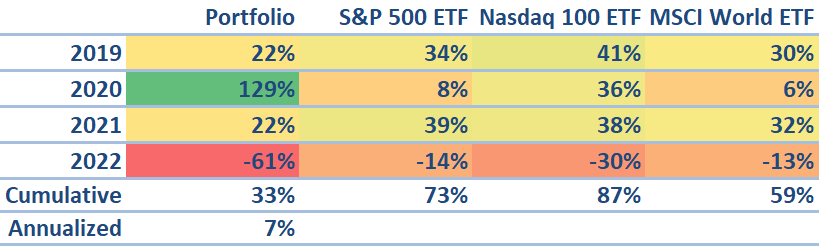

1. My Results Against Benchmarks

Currency: EUR

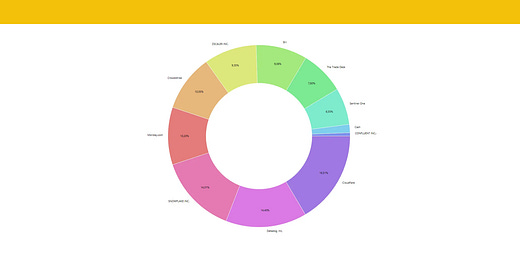

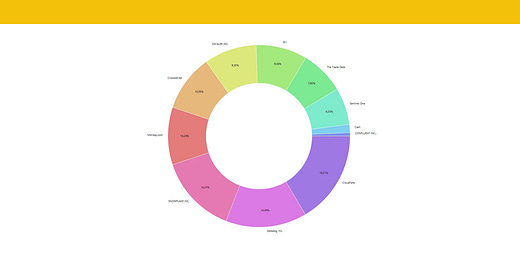

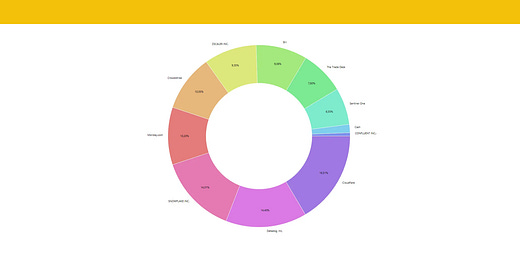

2. My Portfolio

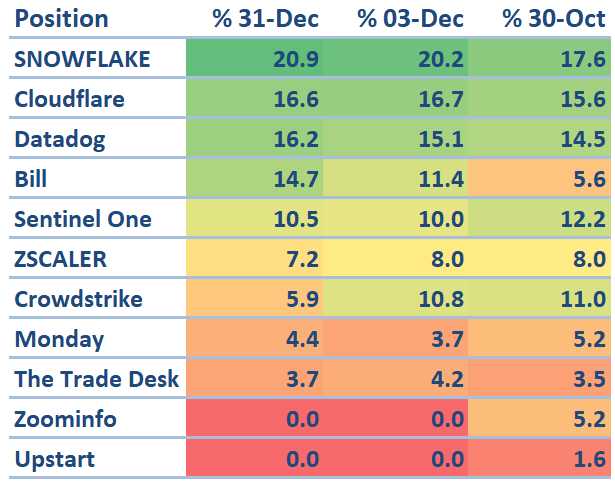

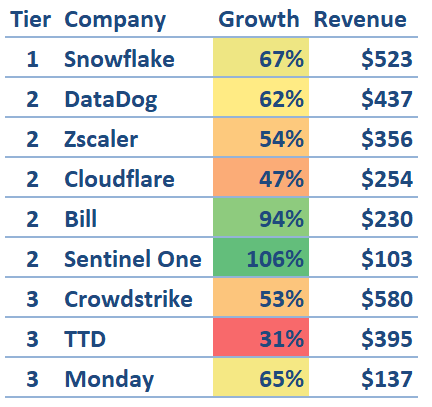

Conviction tiers

Tier 1: Champions enjoy my highest conviction due to excellent company performance and execution. They usually have a 15+% allocation.

Tier 2: Contenders are either rising stars due to good performance, but they lack full confidence, or past champions due to declining performance. They are sized between 5 % and 15 %.

Tier 3: Bench – These positions are either new ones that I want to keep on my radar/get to know or fallen angels which I want to keep for some (bad) reason.

3. What I did last month

Added: Sentinel One

Before Earnings: due to cash freed up from other reduced and sold positions, I shifted a portion into Sentinel One as I like the high growth and steadily improving profitability.

After Earnings: I found the latest quarterly numbers to be mostly positive. Still, I don’t like the negative trend in absolute cash flow, absolute operating, and net income, as well as some degree of “distrust” in management for failing to meet their expectations regarding net new ARR "in the high 50s ".

The question for me is whether I can believe management that they can achieve “50% ARR growth” next year when they are not able to achieve other targets in less than 2 months. Therefore, I will not add to the position at this time.

Added: Snowflake

Q3 numbers showed strong customer growth, strong growth in Remaining Performance Obligations, and a continued phenomenal dollar-based Net Retention Rate indicating strong demand and satisfied customers.

Profitability improved across the board: from Operating, and Net Income to Operating and Free Cash Flow.→ Added to Snowflake.

Added: Cloudflare

I added to Cloudflare before Earnings due to free cash from reduced/sold positions. I have a lot of confidence in Cloudflare based on its quarterly numbers, which have been consistent for several years. The company, like all others, is affected by macroeconomic factors.

Because of these factors, management is pivoting Cloudflare’s focus to profitability. At the expense of growth.

Management is very optimistic, which gives me confidence. To date, they occupy only 1% of their identified market for products they already offer today. And that’s without future products that should increase TAM, even more, → more potential upside.

Metrics like sales growth, major customers, and free cash flow I’ll keep an eye on. The slowing growth, on the other hand - while likely temporary and macroeconomic - does not bolster my confidence.

DataDog, for example, is generating 72% higher revenue, and this should be more vulnerable to customers looking to cut costs immediately because of its usage-based model. But still grows faster while being much more profitable than Cloudflare.

On the other hand: Cloudflare is one of the most reliable and stable companies when it comes to generating revenue growth. One or two weak quarters are most likely macro-driven outliers.

Fundamentally, I see no reason for company-specific problems. Since the position is already very large, I did not add additional tranches after earnings and will wait for the next quarterly numbers.

Added: Bill

BILL delivered a strong quarter. The customer growth was phenomenal, which hardly any company can manage in the current environment. That said, the market currently seems uncertain about how BILL and its various revenue streams (subscriptions, transaction fees, and float revenue) will be affected by macroeconomic circumstances.

While BILL currently enjoys a tailwind due to float revenue, transaction revenue could suffer in the coming quarters due to lower purchasing power.

Still, the company reported very strong customer growth, profitability is moving in the right direction, and management is very confident.

Along with Snowflake, Bill was a highlight of the last earnings season for me → Added.

Added: DataDog

Similar to other companies, revenue, and customer growth accelerated. And this is likely to continue for the time being.

I felt optimistic about a statement from the last earnings call: the macroeconomic environment worldwide had become even worse than in Q2. But their (DataDog’s) own performance in Q3 was in line with Q2, which indicates relative strength. This statement gives me great confidence.

Since DataDog has a consumption-based revenue model, future DataDog quarterly numbers should give us very timely macro insight. If sequential revenue starts to accelerate again, it could be an indication that the macro environment is improving.

After trimming DataDog last month, I started to add again opportunistically due to free cash from other positions.

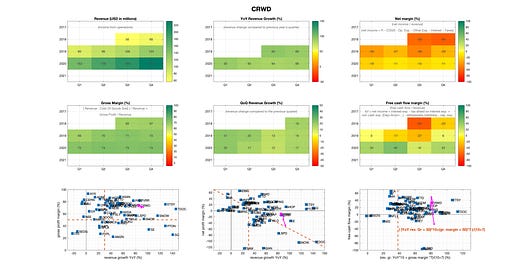

Trimmed: CrowdStrike

Similar to Sentinel One, Crowdstrike has slipped slightly in terms of my Confidence Level. Looking at growth, Sentinel One is growing faster, while CrowdStrike is much more profitable. For that, CrowdStrike has more difficult circumstances to accelerate growth due to the "Law of Large Numbers ".

To me, CrowdStrike’s management made a much more defensive impression in the earnings call than Sentinel One. Crowdstrike is expected to remain a 40% grower in the coming year.

It’s worth noting that while both CrowdStrike and Sentinel One have a subscription-based revenue model, they pay per endpoint (thus effectively per seat). It’s entirely possible that seat-based models have benefited greatly from the mass hiring of new employees in recent years, and are suffering in the wake of the current layoff wave.

Fundamentally, I don’t see isolated problems with either CrowdStrike or Sentinel One.

Nevertheless, I have adjusted Crowdstrike from about 12% to a size appropriate for my confidence level.

Trimmed: Monday

I reduced Monday before earnings because a statement in the ZoomInfo earnings call made me think: Seat-based revenue models are currently much more vulnerable.

But also rising costs, e.g. due to new, expensive offices in top locations, declining revenue, and customer growth were not conducive to my conviction. At “only” $137M, I think revenue growth should slow less. Just 3 quarters ago Monday was growing over 90% year-over-year, they are now at 65%. Still, I expect Monday to continue to deliver over 50% revenue growth, which is why I remain invested in a small position.

I assume that the revenue growth slowdown is largely due to macroeconomic factors and is not a company-specific problem. Since Monday’s subscription model is based on “seats,” they are more susceptible to macro fluctuations. It is unlikely that their customers are currently increasing the number of seats. It’s more likely that customers will reduce Seats due to layoffs.

On the positive side, Monday has become profitable and still delivers a very strong dollar-based net retention rate of 135%+ (!) - and this with a growth of more than 50%.

4. Long Story Short

-61 % in 2022: Not fun.

And, most likely, we will see another lousy “macro quarter” soon

Even after Q1 2023, it will remain unclear when the market will recover.

I usually don’t comment on macro-related topics, since I try to focus on what I can control. Still, as many are interested in this topic, here is my crystal ball prediction:

Inflation won’t rise much further and is going to fall fast during 2023.

Interest rates are starting to fall in late 2023.

Stock prices, led by high growth, are going to recover during Q2 2023. This is happening before company fundamentals are going to improve since wall street is usually looking 3 to 6 months ahead. Which makes timing the market so hard.

Based on the points above, we should see accelerated growth rates in Q3 and Q4 2023.

Once recovery is on the horizon, companies will surprise us with good results. And that will have a strong impact on share prices. That is the positive side of the current environment and a good time to buy stocks.

Ignore the I-told-you-so’s and doomsayers: The fact is, everyone is right. Even a broken clock is right twice a day. Because it’s a matter of time. A question of perspective.

I never tire of emphasizing:

This phase, too, the most severe economic downturn in a long time driven by several effects at the same time will pass. The trend of digitalization is not going away. Then, everyone wants to jump on the bandwagon again. Until the next crash.

But each crash comes with higher lows than any previous one.

That’s the nature of the markets. And our opportunity.

How do I know?

I don’t have 30 years of experience in investing and didn’t experience previous cycles firsthand.

But do I have to have been at war to understand it’s bad?

Honestly, I don’t know how things will turn out. This time it might be different.

I doubt it: For the past few years, I focused on what I can control:

I studied the history of markets.

I read and listened - a lot. Also to you.

Nothing is certain: Playing poker, investing in the right companies, and even living a successful life are all a question of probabilities.

And based on all I know, the odds are on our side.

Happy Investing!

Disclaimer: This text is for informational purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. Please see our disclaimer for more details.